Is the EastMed pipeline really a feasible project?

Is the EastMed pipeline really a feasible project?

The answer to this question is not simple, but the EastMed plan sounds not convincing.

The EastMed pipeline: One option is the construction of a pipeline that would connect gas fields in Cyprus to southern Europe through Greece, injecting gas from the Levantine basin into southern Europe’s gas grid. The planned pipeline is called the eastern Mediterranean Natural Gas Pipeline, or EastMed pipeline for short. In May 2015, the European Commission declared the pipeline a PCI and initiated a technical and commercial feasibility study to assess its viability. The outcome of the study is expected at the end of 2017. By relying on several sources of gas, most likely from Israel and Cyprus, the pipeline will necessarily have a diverse supply source; by enabling European member states to rely more on natural gas than other hydrocarbons, it will take the EU some way towards meeting its reduced emissions targets.

Although the feasibility study has not yet been completed, stakeholders who are seeking the construction of this pipeline have been encouraged by its prospects. In early April, ahead of the outcome of the feasibility study, Israel, Cyprus, Greece and Italy signed a preliminary agreement to commence preparations for the construction of the pipeline, with hopes that it would be completed by 2025.

Stakeholders supporting the pipeline suggest that there is sufficient demand for gas within Europe to make the pipeline commercially viable, even if consumption stagnates. By certain estimates, European demand is projected at 40-60bcm per year, which is in line with the export potential of the region, currently estimated to stand at around 50bcm per year, assuming resources in the region are pooled. The pipeline could go some way towards securing these supplies at a capital cost of around $7 billion dollars.

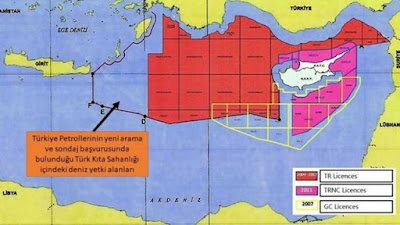

Despite early optimism, a range of issues remain that might hinder the development of this pipeline. On a commercial level, many experts have suggested that it is “more pipedream than pipeline”.There are concerns among experts and industry actors that the budgeted capital investment for the pipeline is understated and that the level of capital investment means the gas will not be competitive, especially in relation to American LNG. On a technical level, experts have also suggested that difficult terrain around Greece would either prohibit the construction of the pipeline or make its cost much higher than current estimates suggest. There are also suggestions that the proposed route for the pipeline fails to address the same political impasse that has plagued Israeli efforts to export directly to Turkey − namely, Turkish claims to sovereignty over Cypriot maritime space.

For now, stakeholders are awaiting the outcome of the feasibility study, at which time the picture will be clearer. The EastMed pipeline would make Cyprus the emerging energy hub of the region, with Egypt possibly connecting its gas fields to it for future pipeline exports, if needed. Many who view this pipeline as theoretically viable still consider it to be a longer-term project, arguing that market forces suggest Egypt could emerge as the region’s primary hub in the shorter-term.

Sometime in early April, the energy ministers of Cyprus, Greece, Israel and Italy met in Tel Aviv, warmly watched by the EU Commissioner for Climate Action and Energy. They had gathered to sign a preliminary agreement to advance a gas pipeline project aimed at linking their four countries: the EastMed pipeline. The project is ambitious, enormous and – at least today – probably unnecessary.

At first glance the EastMed is an impressive idea. The pipeline would transport 10 billion cubic metres per year (Bcm/y) of gas from eastern Mediterranean gas fields to Greece and Italy. About 1900km long, and reaching depths below 3km, it would be the world’s longest and deepest subsea pipeline. The estimated cost is €6.2 billion($7 billion)

But for those who follow European energy security, the ceremony brought a kind of déjà vu. It was difficult not to remember a similar ministerial ceremony that took place in Vienna in June 2006, proclaiming next steps for the Nabucco pipeline.

The two projects have many similarities: huge gas transit capacity; long pipelines; connections between Europe and multiple gas supply sources (in the case of Nabucco, Azerbaijan, Turkmenistan, Iran and Iraq). Both were also predicted to be costly, although the EastMed pipeline is even more expensive than Nabucco’s €5 billion initial estimated pricetag. And in both cases, energy ministers and the European Commission promised that the project would contribute not only to the security of Europe’s gas supply, but also to wider regional cooperation.

As we know, the story of Nabucco did not have a happy end. The project soon proved to be more of a pipe dream than a realistic pipeline project.

So the question now is whether the EastMed pipeline is really a feasible project. Or is it just more wishful thinking from the EU? The answer to this question is not simple, but the EastMed plan sounds unconvincing.

Preliminary feasibility studies claim that the project is viable both technically and commercially. However, these studies make a double bet on future gas trends in the region. On the demand side, they assume a substantial increase in EU gas import requirements. On the supply side, they predict that large amounts of eastern Mediterranean gas will become available for export to Europe.

The first bet looks reasonable, albeit with a caveat. The EU’s gas import requirements are likely to grow in the future, partly due to rapidly declining domestic production. However, this does not necessarily mean that eastern Mediterranean gas will be best positioned to fill the gap. At the end of the day, cost competitiveness will be key. Will Europe satisfy its growing requirements with eastern Mediterranean gas, or simply by increasing deliveries from Russia and other traditional suppliers?

The second assumption, that the eastern Mediterranean is sure to become a major exporter, is even more doubtful. Over the last years various challenges have revealed the limits of the region’s gas potential: continuous investment decision delays in Israel; downward revisions of gas resources in Cyprus; major gas shortages in Egypt.

In fact, only the 2015 discovery of the large-scale Zohr gas field in offshore Egypt, the largest discovery in the Mediterranean, could revitalise the outlook. But Egypt is not interested in the planned EastMed pipeline, having at its disposal two large liquified natural gas (LNG) facilities that currently sit idle. And even if regional gas production accelerates, domestic demand might limit export potential. Egypt’s gas demand is set to rise from the current 50 Bcm/y to around 70 Bcm/y in 2030. Israel expects its gas demand to quadruple by 2040.

In short, the gas export potential of the eastern Mediterranean is still not clearly defined, and it will also depend on domestic gas demand.

With all these uncertainties, it seems premature to discuss such a large and costly project as the EastMed pipeline. EastMed could make sense in years to come, once European gas dynamics and the real export potential of the eastern Mediterranean become clearer. But for the time being it looks like another EU fantasy.

A more reasonable option for the eastern Mediterranean region would be joint use of the existing Egyptian LNG facilities. Indeed, the geographical proximity of Egyptian, Israeli and Cypriot offshore gas fields could well allow coordinated development. This might create the economies of scale needed to make the first gas exports from the eastern Mediterranean region competitively.

Such an approach would also offer eastern Mediterranean gas suppliers flexibility in terms of destination markets. For instance, through Egyptian LNG terminals, these fields could also serve the rapidly growing Turkish market – and not just southern Europe, as would be the case with the EastMed pipeline. Furthermore, a joint regional export scheme via the Egyptian LNG facilities could also provide a first opportunity to test commercial gas cooperation between Egypt, Israel and Cyprus.

If successful, this cooperation could then eventually scale-up in the 2020s, if new gas resources are found in the region and gas demand justifies the construction of additional infrastructure. Only then would it be worth considering grand projects like the EastMed gas pipeline.

CONCLUSION

The prospect for the region to transform into a source of energy and security for Europe will increase the more Europe is willing to engage. Given the relatively favourable global energy market in which the EU currently finds itself, the Eastern Mediterranean might not be its top priority right now, but sustained engagement at this early stage could yield results in the future – not only in terms of supporting the EU’s own energy provision and diversification, but also for improving regional cooperation and security in the Middle East. The EU should play the long game and invest early in formulating policies that can assist the eastern Mediterranean transition into a politically stable economic powerhouse.

Comments

Post a Comment