Does Turkey need Israel's natural gas?

Leviathan Gas Field: Still looking at spending $3 to 4 billion US Dollars before the first gas is extracted.

Israel-Turkey Gas Deal is unlikely due to technical and commercial limitations.

( Leviathan Gas Field is still unproven and is only a prospect.The discoveries in offshore natural gas fields of Israel are an illusion; Leviathan's estimated total capacity is approximately 17tcf or 500bcm and all are based on the probabilistic volumetrics.The company reported on an update of the assessment of the report as classified "contingent and prospective resources in the Leviathan natural gas reservoir" where the appraisals were not adjusted untill an extensive appraisal program commences. The contingent resources are at an undeveloped site, and therefore the appraisal is based on estimated reservoir volume and efficiencies recovery, analogous to reservoirs with similar geological and reservoir characteristics.

Warning - There is no certainty that any part of these potential resources will indeed be discovered. If they are discovered, there is no certainty that it will be commercially viable to produce any part of the resources. The prospective data is not an assessment of reserves and contingent resources that can only be assessed after the exploratory drilling, if at all )

Can the natural gas agreement between Israel and Turkey be in the future?

Turkey has launched the TANAP project to move Azerbaijani gas to its own consumption and to EU countries via Turkey. This huge project with Azerbaijan,Turkmenistan and Kazakhstan are also included.

Russian Energy Minister Aleksandr Novak said that they are prepared to supply the natural gas that Europe needs, taking into account the Turkish Stream natural gas pipeline.

The price of natural gas exported by Iran to Turkey Iran's high price revision was implemented gradually over 10% discount. In the presence of Russia and Iran, Israel can not create a competitive environment in the market. Because the Leviethan gas field is in ultra-deep water, the cost of the gas to be extracted will be quite high/expensive and the cost of fluidization will increase even further.

It is much more expensive than other competitors and does not have the power to compete and. Removing gas to surface in today's market conditions is very costly on an economic and financial basis.

The Eastern Mediterranean natural gas resources seem to be due to the abundance of supply in the world gas sector, the decrease in prices oil indexed to gas prices, the shortage of investment financing,it does not appear that the full capacity will be operated for at least 15 years in the future.

It is very difficult for Israel to emerge in international markets under the current conditions.

STRENGTHEN LNG ALTERNATIVE

Turkey, which wants to strengthen its energy supply, can not buy the Israeli gas. If Turkey does not go through the natural gas trade like it wants, Turkey will not be without options.

Liquefied natural gas (LNG), which is increasingly used due to falling oil prices, can be thought of as a much more sensible solution. Turkey can import the amount of gas that it can import via pipeline from Israel by establishing new LNG facilities, and short-term pipeline contracts may prefer to import LNG with futures contracts.Thus, the desired LNG exporter can supply gas from the country.

As of today, 33% of the world's natural gas trade is done by LNG method and it is expected that the price increase of natural gas will be independent of oil indexed gas prices with the increase of this ratio in the coming period.

Another prospect for the coming period is a period of gas abundance in which players such as Australia and USA become major exporters with the shale gas revolution.

The need to sell natural gas that Israel possesses when LNG is on the rise and nearing the abundance-gas-low price period, much more than the need to diversify Turkey's natural gas supply.

Israel’s gas export ambitions struggles against economic limitations!..

Since the major discoveries of gas in 2010, Israel has gone out in all directions to find viable export routes for its gas but with limited results so far.

So far only the two modest agreements to export gas to Jordan are active. In fact gas started to trickle to the Potash Company where 66 billion cubic feet (bcf) are contracted to be exported over 15 years. The other agreement with Jordan’s electricity company is expected to start in 2019, if the Leviathan field is developed, for the export of 530 bcf over 15 years.

The opposition to this agreement and the possibility of restarting imports from Egypt may change this outlook.

The option to export to Egypt by reversing the pipeline and by building sea lines to Egypt’s two LNG plants is off the table because the latter is no longer interested. Instead, it is concentrating on expediting its new discoveries at sea and on land where it is likely to be self-sufficient in 2019.

Egypt also made an agreement with Cyprus for a pipeline to use the LNG facilities, especially if further discoveries are made in Cyprus due to the current licensing round. This rules out the option for Israel to put up a joint LNG plant to process Israeli and Cypriot gas jointly on either the Cyprus or Israel side.

Israel’s export of gas to Turkey and then to Europe — which was more in the news in the last 3 years — is now dormant.

While Turkey always welcomes the export of hydrocarbons through its territories, there are many problems that must be resolved before this option can materialise...At the end of the day, "cost competitiveness will be key”, meaning that the project would be uncompetitive with Russian gas deliveries and that the project “looks like another Israeli fantasy"

Israeli gas is not competitive under the current market conditions because of the declining gas prices and also highly expensive extraction costs of gas in the offshore deep-water activities.

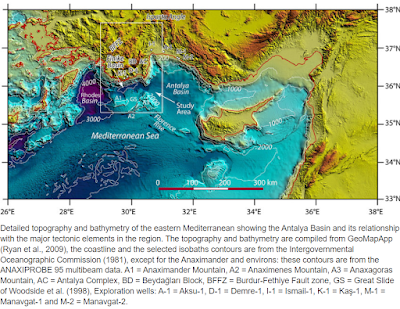

At this point, it is premature to judge the feasibility and commerciality of a gas pipeline that would connect Israeli gas to Turkey. It’s long distance of circa 600 km’s and over ultra deep waters will be expensive to construct. Developing gas production and exports in the eastern Mediterranean will pose technical and geological difficulties as the waters between Israel and Cyprus are among the deepest in the Mediterranean Sea. The challenges of engineering and construction, management and time related, economic, and geopolitical, are ample. The region is seismically active, making pipeline solutions difficult to implement. This is technologically difficult to implement, as pipes will have to be laid in extreme depths.

Does Turkey need Israel's natural gas?

Turkey does not have to buy gas from Israel.

Noble Energy plans to export 10 billion cubic meters/y (bcm) Leviathan field in the short term and a long-term supply of 30 billion m3/y of natural gas.It is expected that 10 billion m3/y will be exported to Turkey, where annual consumption is about 50 billion m3/y and the remainder will be shipped to Europe.

Natural gas prices are running low simultaneously with oil prices. It is unlikely that the capacity of the Leviathan area in the light of this data will enable Turkey and Europe to meet their natural gas needs in high percentages and for a long time.Increasing use of LNG due to falling oil prices can be considered as a much more sensible solution

Europe's annual natural gas consumption is about 400 billion m3, equivalent to 3% of Europe. The region is predicted to have the potential to make explorations & discoveries in the future, but investing in gas for future gas is not economically sensible

What are the reasons why Israeli natural gas is not attractive for the Turkish market?

The reasons why concrete steps can not be taken to date can be summarized as follows;

Discussions on whether or not the project is "feasible" under current conditions and at cost, due to falling energy prices, and investors should not be interested:

The cost of a drilling in ultra deep water is about $ 130 / $ 150 million and the cost of c. $130 million in high& risky environments due to falling gas prices may not seem very reasonable.

Information on the chemical composition of natural gas has not been included in the explanations made so far. Depending on the chemical composition of the gas, additional costs may come to the agenda.

It is important to note that the price of the gas to be produced by the wellhead and the cost of shipping offshore will not be clear yet. The Noble-Delek partnership will not allow Tamar to lower the price of gas given to the domestic market in Israel to $ 5.50 / mmBTU, because they emphasize that legal issues will arise on the grounds that the export will be subsidized. It is even said that the cost of the gas will be at least $ 6 / Mbtu.

Under the present conjecture I can say that Israeli gas can not come to Turkey at competitive prices when it is thought that the Russian delivery price of gas to Thrace is now c.$ 4.7 - 4.8/mmBTU.

Moreover, with the Turkish Stream project, Russians are pointing to the fact that the price of Russian gas will decrease further with the direct gas supply to Thrace, and that Gazprom can also give gas to Turkish private sector again.

There are also energy experts who claim that the Leviathan project can only be "done" if oil prices reach $ 80/90 dollars/barrel and natural gas prices reach around $ 10 / mmbtu.

Turkey also has to take into account the possible "excess supply" issue that will arise in the coming years as a natural gas trading center. There are about 52 billion cubic meters/year of pipeline and LNG contracts from the countries that Turkey imports natural gas today. I am talking about the gas that is attached to the contract of 6 billion cubic meters which is coming from TANAP 2019 onwards and which we put in the contract of 58 billion cubic meters.

The fact that Turkey's share of gas in electricity generation will continue to decline in the coming years indicates that we have come to the end of the high-growth period of gas demand in recent years. By 2020, I estimate that with an optimistic estimate, Turkey will have a gas consumption of 49-51 billion cubic meters. If you add 10 billion cubic meters of Northern Iraq and possibly 7 billion cubic meters of Israeli gas that could enter the system after 2021, there might be a possibility of a gas entry capacity of 75 billion cubic meters. When we add FSRU terminal projects to this, I see that Turkey will have a gas inflow far above the demand.

Israel-Turkey Gas Deal is unlikely due to technical and commercial limitations.

( Leviathan Gas Field is still unproven and is only a prospect.The discoveries in offshore natural gas fields of Israel are an illusion; Leviathan's estimated total capacity is approximately 17tcf or 500bcm and all are based on the probabilistic volumetrics.The company reported on an update of the assessment of the report as classified "contingent and prospective resources in the Leviathan natural gas reservoir" where the appraisals were not adjusted untill an extensive appraisal program commences. The contingent resources are at an undeveloped site, and therefore the appraisal is based on estimated reservoir volume and efficiencies recovery, analogous to reservoirs with similar geological and reservoir characteristics.

Warning - There is no certainty that any part of these potential resources will indeed be discovered. If they are discovered, there is no certainty that it will be commercially viable to produce any part of the resources. The prospective data is not an assessment of reserves and contingent resources that can only be assessed after the exploratory drilling, if at all )

Can the natural gas agreement between Israel and Turkey be in the future?

Turkey has launched the TANAP project to move Azerbaijani gas to its own consumption and to EU countries via Turkey. This huge project with Azerbaijan,Turkmenistan and Kazakhstan are also included.

Russian Energy Minister Aleksandr Novak said that they are prepared to supply the natural gas that Europe needs, taking into account the Turkish Stream natural gas pipeline.

The price of natural gas exported by Iran to Turkey Iran's high price revision was implemented gradually over 10% discount. In the presence of Russia and Iran, Israel can not create a competitive environment in the market. Because the Leviethan gas field is in ultra-deep water, the cost of the gas to be extracted will be quite high/expensive and the cost of fluidization will increase even further.

It is much more expensive than other competitors and does not have the power to compete and. Removing gas to surface in today's market conditions is very costly on an economic and financial basis.

The Eastern Mediterranean natural gas resources seem to be due to the abundance of supply in the world gas sector, the decrease in prices oil indexed to gas prices, the shortage of investment financing,it does not appear that the full capacity will be operated for at least 15 years in the future.

It is very difficult for Israel to emerge in international markets under the current conditions.

STRENGTHEN LNG ALTERNATIVE

Turkey, which wants to strengthen its energy supply, can not buy the Israeli gas. If Turkey does not go through the natural gas trade like it wants, Turkey will not be without options.

Liquefied natural gas (LNG), which is increasingly used due to falling oil prices, can be thought of as a much more sensible solution. Turkey can import the amount of gas that it can import via pipeline from Israel by establishing new LNG facilities, and short-term pipeline contracts may prefer to import LNG with futures contracts.Thus, the desired LNG exporter can supply gas from the country.

As of today, 33% of the world's natural gas trade is done by LNG method and it is expected that the price increase of natural gas will be independent of oil indexed gas prices with the increase of this ratio in the coming period.

Another prospect for the coming period is a period of gas abundance in which players such as Australia and USA become major exporters with the shale gas revolution.

The need to sell natural gas that Israel possesses when LNG is on the rise and nearing the abundance-gas-low price period, much more than the need to diversify Turkey's natural gas supply.

Israel’s gas export ambitions struggles against economic limitations!..

Since the major discoveries of gas in 2010, Israel has gone out in all directions to find viable export routes for its gas but with limited results so far.

So far only the two modest agreements to export gas to Jordan are active. In fact gas started to trickle to the Potash Company where 66 billion cubic feet (bcf) are contracted to be exported over 15 years. The other agreement with Jordan’s electricity company is expected to start in 2019, if the Leviathan field is developed, for the export of 530 bcf over 15 years.

The opposition to this agreement and the possibility of restarting imports from Egypt may change this outlook.

The option to export to Egypt by reversing the pipeline and by building sea lines to Egypt’s two LNG plants is off the table because the latter is no longer interested. Instead, it is concentrating on expediting its new discoveries at sea and on land where it is likely to be self-sufficient in 2019.

Egypt also made an agreement with Cyprus for a pipeline to use the LNG facilities, especially if further discoveries are made in Cyprus due to the current licensing round. This rules out the option for Israel to put up a joint LNG plant to process Israeli and Cypriot gas jointly on either the Cyprus or Israel side.

Israel’s export of gas to Turkey and then to Europe — which was more in the news in the last 3 years — is now dormant.

While Turkey always welcomes the export of hydrocarbons through its territories, there are many problems that must be resolved before this option can materialise...At the end of the day, "cost competitiveness will be key”, meaning that the project would be uncompetitive with Russian gas deliveries and that the project “looks like another Israeli fantasy"

Israeli gas is not competitive under the current market conditions because of the declining gas prices and also highly expensive extraction costs of gas in the offshore deep-water activities.

At this point, it is premature to judge the feasibility and commerciality of a gas pipeline that would connect Israeli gas to Turkey. It’s long distance of circa 600 km’s and over ultra deep waters will be expensive to construct. Developing gas production and exports in the eastern Mediterranean will pose technical and geological difficulties as the waters between Israel and Cyprus are among the deepest in the Mediterranean Sea. The challenges of engineering and construction, management and time related, economic, and geopolitical, are ample. The region is seismically active, making pipeline solutions difficult to implement. This is technologically difficult to implement, as pipes will have to be laid in extreme depths.

Does Turkey need Israel's natural gas?

Turkey does not have to buy gas from Israel.

Noble Energy plans to export 10 billion cubic meters/y (bcm) Leviathan field in the short term and a long-term supply of 30 billion m3/y of natural gas.It is expected that 10 billion m3/y will be exported to Turkey, where annual consumption is about 50 billion m3/y and the remainder will be shipped to Europe.

Natural gas prices are running low simultaneously with oil prices. It is unlikely that the capacity of the Leviathan area in the light of this data will enable Turkey and Europe to meet their natural gas needs in high percentages and for a long time.Increasing use of LNG due to falling oil prices can be considered as a much more sensible solution

Europe's annual natural gas consumption is about 400 billion m3, equivalent to 3% of Europe. The region is predicted to have the potential to make explorations & discoveries in the future, but investing in gas for future gas is not economically sensible

What are the reasons why Israeli natural gas is not attractive for the Turkish market?

The reasons why concrete steps can not be taken to date can be summarized as follows;

Discussions on whether or not the project is "feasible" under current conditions and at cost, due to falling energy prices, and investors should not be interested:

The cost of a drilling in ultra deep water is about $ 130 / $ 150 million and the cost of c. $130 million in high& risky environments due to falling gas prices may not seem very reasonable.

Information on the chemical composition of natural gas has not been included in the explanations made so far. Depending on the chemical composition of the gas, additional costs may come to the agenda.

It is important to note that the price of the gas to be produced by the wellhead and the cost of shipping offshore will not be clear yet. The Noble-Delek partnership will not allow Tamar to lower the price of gas given to the domestic market in Israel to $ 5.50 / mmBTU, because they emphasize that legal issues will arise on the grounds that the export will be subsidized. It is even said that the cost of the gas will be at least $ 6 / Mbtu.

Under the present conjecture I can say that Israeli gas can not come to Turkey at competitive prices when it is thought that the Russian delivery price of gas to Thrace is now c.$ 4.7 - 4.8/mmBTU.

Moreover, with the Turkish Stream project, Russians are pointing to the fact that the price of Russian gas will decrease further with the direct gas supply to Thrace, and that Gazprom can also give gas to Turkish private sector again.

There are also energy experts who claim that the Leviathan project can only be "done" if oil prices reach $ 80/90 dollars/barrel and natural gas prices reach around $ 10 / mmbtu.

Turkey also has to take into account the possible "excess supply" issue that will arise in the coming years as a natural gas trading center. There are about 52 billion cubic meters/year of pipeline and LNG contracts from the countries that Turkey imports natural gas today. I am talking about the gas that is attached to the contract of 6 billion cubic meters which is coming from TANAP 2019 onwards and which we put in the contract of 58 billion cubic meters.

The fact that Turkey's share of gas in electricity generation will continue to decline in the coming years indicates that we have come to the end of the high-growth period of gas demand in recent years. By 2020, I estimate that with an optimistic estimate, Turkey will have a gas consumption of 49-51 billion cubic meters. If you add 10 billion cubic meters of Northern Iraq and possibly 7 billion cubic meters of Israeli gas that could enter the system after 2021, there might be a possibility of a gas entry capacity of 75 billion cubic meters. When we add FSRU terminal projects to this, I see that Turkey will have a gas inflow far above the demand.

Nice article. It is really important to make drilling cost effective. Here you shared all points regarding natural gas in Israel. I really appreciate information provided. Thanks

ReplyDelete