Israel’s gas export ambitions struggles against economic limitations!..

Since the major discoveries of gas in 2010, Israel has gone out in all directions to find viable export routes for its gas ... but with limited results so far.

So far only the two modest agreements to export gas to Jordan are active. In fact gas started to trickle to the Potash Company where 66 billion cubic feet (bcf) are contracted to be exported over 15 years. The other agreement with Jordan’s electricity company is expected to start in 2019, if the Leviathan field is developed, for the export of 530 bcf over 15 years

The opposition to this agreement and the possibility of restarting imports from Egypt may change this outlook.

The option to export to Egypt by reversing the pipeline and by building sea lines to Egypt’s two LNG plants is off the table because the latter is no longer interested. Instead, it is concentrating on expediting its new discoveries at sea and on land where it is likely to be self-sufficient in 2019.

Egypt also made an agreement with Cyprus for a pipeline to use the LNG facilities, especially if further discoveries are made in Cyprus due to the current licensing round. This rules out the option for Israel to put up a joint LNG plant to process Israeli and Cypriot gas jointly on either the Cyprus or Israel side.

Israel’s export of gas to Turkey and then to Europe — which was more in the news in the last 3 years — is now dormant.

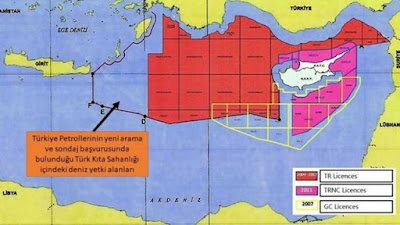

While Turkey always welcomes the export of hydrocarbons through its territories, there are many problems that must be resolved before this option can materialise.

Cyprus issue

The Energy and Water Minister Yuval Steinitz previously said that this could happen by 2019. While this looks absurd now given the reluctance of private investors to put $3 billion (according to the Turkish media channels) in a project that is opposed even by many Israelis because of “Islamic Turkey” and at a time when gas prices have fallen by about 50 per cent. At the same time, the project could be derailed if the division of Cyprus is not resolved.

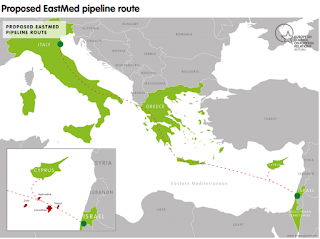

The EastMed pipeline

The planned pipeline is called the Eastern Mediterranean Natural Gas Pipeline, or EastMed pipeline for short. In May 2015, the European Commission declared the pipeline a PCI and initiated a technical and commercial feasibility study to assess its viability.The outcome of the study is expected at the end of 2017.Although the feasibility study has not yet been completed, stakeholders who are seeking the construction of this pipeline have been encouraged by its prospects.

The East Mediterranean Pipeline is the only option where some development is reported. The offshore/onshore line is to carry 530 billion cubic feet of gas annually to Europe, passing through Cyprus and Crete and onward to the Greek network and the Poseidon pipeline of Italy.

The company IGI Poseidon was formed to promote the 2,000 kilometre long project (the longest in the world) costing $7/8 billion and taking 8 years to build.

In early April, energy ministers from Greece, Cyprus, Italy and Israel signed a joint declaration to “promote” the construction of the pipeline that would connect gasfields offshore of Israel and Cyprus with Greece and “possibly” Italy.

It is said that “This is going to be the longest and deepest subsea gas pipeline in the world.” They hoped to see gas flowing through the pipeline by 2025.

Commission requirements

The European Commissioner for Climate Action and Energy Miguel Arias Cañete jumped on the bandwagon by saying: “We support the East Med project and look forward to the rapid completion of the study phase.”

They are only talking about a study phase now hoping that the project would meet the “commission requirements and receive further financial backing for continued research.” Cañete acknowledged that the European Commission cannot yet make definite commitments even though the pipeline is considered an EU Project of Common Interest and the European Commission co-financed the project’s feasibility study.

The Jerusalem Post reported that the ministers expressed confidence that private companies such as IGI Poseidon would deem the plans an attractive investment. The company that completed the feasibility study sees a final investment decision by 2020.

Without diminishing the importance of these statements, they are just nice talk and nothing concrete is to be seen on the ground soon.

Cost competitiveness

Simone Tagliapietra, of the Fondazione Eni Enrico Mattei said: “The project is ambitious, enormous and — at least today — probably unnecessary.” He compared the project to the defunct Nabucco pipeline and concluded that its fate may be the same.

Considering current gas prices, Tagliapietra said: “At the end of the day, cost competitiveness will be key”, meaning that the project would be uncompetitive with Russian gas deliveries and that the project “looks like another EU fantasy”.

The question is not rhetoric and alludes to the fact that 10 years after the discovery of the Leviathan field offshore in Israel and 6 years after the finding of the smaller,but significant,,Aphrodite reservoir within Cyprus’ EEZ, not a single cubic feet of gas have been exported nor is it likely any time soon.

Comments

Post a Comment