East Med Pipeline: HYPE, HOPE and POLITICS!..

In pipeline business often politics comes before economics!!!

A study on the technical and commercial feasibility of the Eastern Mediterranean Pipeline Project with the participation of the energy ministers of Cyprus, Italy, Greece and Israel was shared with the international public opinion under the leadership of the EU Energy Directorate. The EU financed work was done by the EDISON company, which previously planned the IGI and POSEIDON projects.

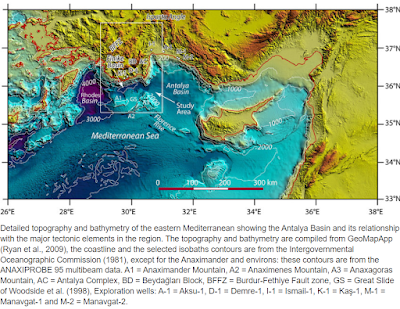

According to EDISON's study, the Eastern Mediterranean Pipeline project will be able to reach Greece through the island of Crete and Poseidon with Italy after coming to Cyprus from the Leviathan gas field of Israel (the map of the East Mediterranean Pipeline project, which is expressed in yellow on the map, will reach Greece through the island of Crete after going to Cyprus from the Leviathan area of Israel. From here, Poseidon, shown in blue, will have the opportunity to reach Bulgarian markets through gray and red lines to Italy)

The capacity of the project is estimated at 16 billion m3 /year. In this context: a pipeline construction of 200 km from Cyprus, 700 km from Crete, 400 km from Crete to Greece, and 600 km from Greece is planned for Leviathan and Aphrodite fields(The total distance is about 1,880 km. Approximately 330 km of the pipeline lies within the exclusive economic zone of Cyprus, 1,250 km is within Greece’s (approximately 635 km of which is onshore), 80 km is within Italy’s and 220 km within Israel’s) The pipeline land area is designed to be between 42" and 24" - 32". For this pipeline, an investment cost of around $ 6 billion was calculated...

While it is not known how a firm such as EDISON calculates such a cost, it is inconsistent with what criterion it takes into account, and it is clear that there is a political direction for the purpose of perception. This is because, if the costs of the relevant parts are compared to the pipelines in the same region (TAP started for construction in the last period for the sea part, TANAP for the land part), the figure will be very different. On the other hand, if such a pipeline is decided, even if it is thought that it can be completed within 5 years at the earliest 2023 line will pass by.

In this case, it is not certain what amount of supply will remain in the hands of Israel as a result of gas sales agreements to be made. In addition, steel, oil and construction costs after 5 years have to be recalculated.

However, if a general investment cost is calculated (Note: Diameter is 42 "for marine parts of the pipeline and 32" for marine parts and aproximately $15 millions is calculated based on per/km for steel pipes) compared to other similar pipelines in the region:

200 km from Leviathan and Aphrodite fields to Cyprus About $ 3 billion,

from Cyprus to about $10 billion for 700 km to Crete ,

from Crete to Greece about $4 billion for a portion of 400 km,

to Greece about 600 km a cost of $ 6 billion is foreseen.

In total, the Eastern Mediterranean Project will cost about $25 billion before it reaches the Italian market. This cost is expected to bring about an average load of $ 260/1000 m3 (tariff) when project profitability criteria are taken into consideration.If the cost of transport is also added, for example, to the cost of accessing the Italian market, if the EU is considered to have higher gas prices than the domestic market, such a project is not likely to have a chance to survive... In addition to all these costs, there is doubt that Israel's potential for exporting the remaining gas and the potential production sum of the Aphrodite area of Cyprus will be around 16 billion m3 / year on a regular basis. In order to reduce costs a bit, the fact that the diameter of the pipe for the sea part is chosen between 24 "and 32" indicates that the shipment is expected to be less than 16 billion m3 / year. If transportation costs, taxes, insurance and production costs are already added,it will be even better understood that the project will be impossible.

As a result, this project, prepared for EDISON, It is not commercially and economically feasible, as the relevant authorities have explained. The development of the Aphrodite site in Cyprus and the evaluation of the residual gas export potential of Israel, the presence of more than 99% methane in the gas in the respective area, increases the costs of the LNG option. Along with this, there is only one Egyptian market that can be reached by pipelines. It is also necessary to analyze the production profiles of the newly exploited lands with its increased consumption with a great acceleration and to construct the long-circulating gas equation.

A study on the technical and commercial feasibility of the Eastern Mediterranean Pipeline Project with the participation of the energy ministers of Cyprus, Italy, Greece and Israel was shared with the international public opinion under the leadership of the EU Energy Directorate. The EU financed work was done by the EDISON company, which previously planned the IGI and POSEIDON projects.

According to EDISON's study, the Eastern Mediterranean Pipeline project will be able to reach Greece through the island of Crete and Poseidon with Italy after coming to Cyprus from the Leviathan gas field of Israel (the map of the East Mediterranean Pipeline project, which is expressed in yellow on the map, will reach Greece through the island of Crete after going to Cyprus from the Leviathan area of Israel. From here, Poseidon, shown in blue, will have the opportunity to reach Bulgarian markets through gray and red lines to Italy)

The capacity of the project is estimated at 16 billion m3 /year. In this context: a pipeline construction of 200 km from Cyprus, 700 km from Crete, 400 km from Crete to Greece, and 600 km from Greece is planned for Leviathan and Aphrodite fields(The total distance is about 1,880 km. Approximately 330 km of the pipeline lies within the exclusive economic zone of Cyprus, 1,250 km is within Greece’s (approximately 635 km of which is onshore), 80 km is within Italy’s and 220 km within Israel’s) The pipeline land area is designed to be between 42" and 24" - 32". For this pipeline, an investment cost of around $ 6 billion was calculated...

While it is not known how a firm such as EDISON calculates such a cost, it is inconsistent with what criterion it takes into account, and it is clear that there is a political direction for the purpose of perception. This is because, if the costs of the relevant parts are compared to the pipelines in the same region (TAP started for construction in the last period for the sea part, TANAP for the land part), the figure will be very different. On the other hand, if such a pipeline is decided, even if it is thought that it can be completed within 5 years at the earliest 2023 line will pass by.

In this case, it is not certain what amount of supply will remain in the hands of Israel as a result of gas sales agreements to be made. In addition, steel, oil and construction costs after 5 years have to be recalculated.

However, if a general investment cost is calculated (Note: Diameter is 42 "for marine parts of the pipeline and 32" for marine parts and aproximately $15 millions is calculated based on per/km for steel pipes) compared to other similar pipelines in the region:

200 km from Leviathan and Aphrodite fields to Cyprus About $ 3 billion,

from Cyprus to about $10 billion for 700 km to Crete ,

from Crete to Greece about $4 billion for a portion of 400 km,

to Greece about 600 km a cost of $ 6 billion is foreseen.

In total, the Eastern Mediterranean Project will cost about $25 billion before it reaches the Italian market. This cost is expected to bring about an average load of $ 260/1000 m3 (tariff) when project profitability criteria are taken into consideration.If the cost of transport is also added, for example, to the cost of accessing the Italian market, if the EU is considered to have higher gas prices than the domestic market, such a project is not likely to have a chance to survive... In addition to all these costs, there is doubt that Israel's potential for exporting the remaining gas and the potential production sum of the Aphrodite area of Cyprus will be around 16 billion m3 / year on a regular basis. In order to reduce costs a bit, the fact that the diameter of the pipe for the sea part is chosen between 24 "and 32" indicates that the shipment is expected to be less than 16 billion m3 / year. If transportation costs, taxes, insurance and production costs are already added,it will be even better understood that the project will be impossible.

As a result, this project, prepared for EDISON, It is not commercially and economically feasible, as the relevant authorities have explained. The development of the Aphrodite site in Cyprus and the evaluation of the residual gas export potential of Israel, the presence of more than 99% methane in the gas in the respective area, increases the costs of the LNG option. Along with this, there is only one Egyptian market that can be reached by pipelines. It is also necessary to analyze the production profiles of the newly exploited lands with its increased consumption with a great acceleration and to construct the long-circulating gas equation.

Comments

Post a Comment