Israel-Turkey pipeline unlikely!

Turkey Unlikely to Sign Gas Pipeline Deal With Israel...

The discoveries of offshore natural gas fields off Israel are an illusion...

Leviathan Gas Field: But still looking at the prospect of spending $5-6 billion before the first gas comes... Leviethan Gas Field is still unproved,still a prospect... Israel-Turkey Gas Deal Unlikely, Due to technical,commercial limitations... Israeli gas to Turkey Commercially/financially not viable- technically not feasible...

Israeli gas is not competitive,can't compete...Cost-effectiveness analysis is VITAL...

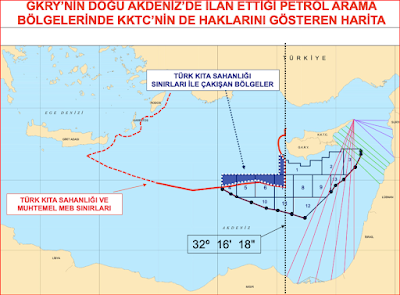

Firstly,there are legal and legislative restrictions on Israel’s gas exports with about half of the gas stipulated for Israel’s domestic consumption. Secondly,the prospects of a pipeline linking Israel's Leviathan natural gas to Europe via Turkey are only pipe dream because the project's biggest obstacles are practical. Thirdly,It is difficult to connect Israel to Southern Gas Corridor.The practicalities and specifically, the infrastructure needs of connecting Israeli gas to the Southern Gas Corridor will make it difficult to accomplish...

Israel cannot compete in gas market... Israeli gas is not competitive under the current market conditions because of the declining gas prices and also highly expensive extraction costs of gas in the offshore deep water activities...At this point, it is premature to judge the feasibility and commerciality of a gas pipeline that would connect Israeli gas to Turkey...It’s long distance c.600kms and over ultra deep waters, and will be expensive to construct. Developing gas production and exports in the eastern Mediterranean will pose technical and geological difficulties as the waters between Israel and Cyprus are among the deepest in the Mediterranean Sea...The challenges of engineering and construction, management and time related, economic, and geopolitical, are ample...The region is seismically active, making pipeline solutions difficult to implement.This is technologically difficult to implement as pipe will have to be laid in extreme depths...

In May 2012, drilling operations at the Leviathan wells were suspended. The suspension took place due to high well pressure and mechanical restrictions of the well-bore design.(Drilling of Leviathan-2 well was started in March 2011 by the Pride North America rig. The drilling operations, however, had to be stopped after detecting a flow of water in the well hole. Leviathan well-1A was also suspended. The suspension took place due to high well pressure and mechanical restrictions of the well-bore design) Lots of "if's" lots of "but's" and It is also turned out that the gas formation is more complex than originally thought... The Final Investment Decision (FID) for the project was taken in late February by the operator Noble and the Israeli Delek. The Leviathan field will be developed using a subsea system that connects production wells to a fixed platform located offshore with tie-in onshore in the northern part of Israel. First gas from the field, located in the Mediterranean Sea, is planned for the end of 2019.Noble Energy will drill the Leviathan-7 development and production well in a batch with the Leviathan-5 well to reduce the costs. With regards in the above technical/geological details please focus on the ultra-deep water depths and the suspension of drilling operations in the Leviethan gas field...

Nothing is certain in this industry ,unless Exploration and drilling by Noble Energy at the Leviathan field and wells once commences with the sophisticated equipments & the use of technology/technique.

Despite the effectiveness of 3D seismic surveys in detecting the presence of a geological cap within which hydrocarbons could lie, imperfections still cast doubts as to the level of accuracy of the technique.There is also the need to process the wealth of data gathered during the first appraisal well and update the prevailing geological and other reservoir models...

Selling Israeli gas to Turkey? So at what price? Israel cannot compete in gas market,isn't competitive enough to compete with LNG [liquefied natural gas] from other countries.Israeli gas is not competitive under the current market conditions because of the declining gas prices and also highly expensive extraction costs of gas in the offshore deep water activities.What about the cost calculations based on the cost-effective metedology of pipes,transportation, regassification expenses and the total cost price? Israel wants to ensure it maximizes export revenues and can properly manage the facility’s security, making a terminal outside of Israeli territory unlikely. An alternative is an LNG facility within Israel, but environmental opposition, interference with tourist destinations, and competition for space with container ports present challenges to this approach.

The development of the Leviathan, which is again inching forward now that the Israeli government is settling its differences with Noble Energy and Delek Group, could be a significant milestone for the region. It will introduce a very large source of natural gas for Israel and its neighbors, providing an economic boost while offering potentially positive (although largely theoretical) geopolitical benefits. But talk of a larger “game changer” with the Leviathan is quite clearly overstated. Energy trade can contribute to positive cooperation, but it is unlikely to single-handedly transform the longstanding points of conflict between Israel and its neighbors.

Furthermore, exports to Europe are questionable, if not unlikely. A pipeline is too expensive, and LNG export terminals face technical challenges, not to mention long lead times. As a result, offshore gas in the Eastern Mediterranean will likely remain a regional story, rather than a global one. The Eastern Mediterranean is not an easy environment. Low prices will affect deep-water activities and could drive certain companies to reconsider certain projects that could become unprofitable...Under current market conditions, the prospects for upstream activity in the East Mediterranean is not particularly favorable, although other elements may be considered when it comes to the decision to be involved in a country’s oil and gas sector...Such developments could make the Eastern Mediterranean a difficult environment for medium-sized companies.This has forced companies to consider certain measures, such as cutting down their budget, abandoning costly projects, selling assets or even mergers...Natural gas project financing is different from oil. The main difference lies in marketability of gas. The problem with gas is transportation as pipelines are the best means but they have only two ends (seller and buyer) and are expensive to put in place. Furthermore, only regional markets exist for gas in which prices are different according to their regional demand...The nonexistence of international market is of a major concern to bankability of gas projects...

No long term contracts, no gas sales(exports)

The discoveries of offshore natural gas fields off Israel are an illusion...

Leviathan Gas Field: But still looking at the prospect of spending $5-6 billion before the first gas comes... Leviethan Gas Field is still unproved,still a prospect... Israel-Turkey Gas Deal Unlikely, Due to technical,commercial limitations... Israeli gas to Turkey Commercially/financially not viable- technically not feasible...

Israeli gas is not competitive,can't compete...Cost-effectiveness analysis is VITAL...

Firstly,there are legal and legislative restrictions on Israel’s gas exports with about half of the gas stipulated for Israel’s domestic consumption. Secondly,the prospects of a pipeline linking Israel's Leviathan natural gas to Europe via Turkey are only pipe dream because the project's biggest obstacles are practical. Thirdly,It is difficult to connect Israel to Southern Gas Corridor.The practicalities and specifically, the infrastructure needs of connecting Israeli gas to the Southern Gas Corridor will make it difficult to accomplish...

Israel cannot compete in gas market... Israeli gas is not competitive under the current market conditions because of the declining gas prices and also highly expensive extraction costs of gas in the offshore deep water activities...At this point, it is premature to judge the feasibility and commerciality of a gas pipeline that would connect Israeli gas to Turkey...It’s long distance c.600kms and over ultra deep waters, and will be expensive to construct. Developing gas production and exports in the eastern Mediterranean will pose technical and geological difficulties as the waters between Israel and Cyprus are among the deepest in the Mediterranean Sea...The challenges of engineering and construction, management and time related, economic, and geopolitical, are ample...The region is seismically active, making pipeline solutions difficult to implement.This is technologically difficult to implement as pipe will have to be laid in extreme depths...

In May 2012, drilling operations at the Leviathan wells were suspended. The suspension took place due to high well pressure and mechanical restrictions of the well-bore design.(Drilling of Leviathan-2 well was started in March 2011 by the Pride North America rig. The drilling operations, however, had to be stopped after detecting a flow of water in the well hole. Leviathan well-1A was also suspended. The suspension took place due to high well pressure and mechanical restrictions of the well-bore design) Lots of "if's" lots of "but's" and It is also turned out that the gas formation is more complex than originally thought... The Final Investment Decision (FID) for the project was taken in late February by the operator Noble and the Israeli Delek. The Leviathan field will be developed using a subsea system that connects production wells to a fixed platform located offshore with tie-in onshore in the northern part of Israel. First gas from the field, located in the Mediterranean Sea, is planned for the end of 2019.Noble Energy will drill the Leviathan-7 development and production well in a batch with the Leviathan-5 well to reduce the costs. With regards in the above technical/geological details please focus on the ultra-deep water depths and the suspension of drilling operations in the Leviethan gas field...

Nothing is certain in this industry ,unless Exploration and drilling by Noble Energy at the Leviathan field and wells once commences with the sophisticated equipments & the use of technology/technique.

Despite the effectiveness of 3D seismic surveys in detecting the presence of a geological cap within which hydrocarbons could lie, imperfections still cast doubts as to the level of accuracy of the technique.There is also the need to process the wealth of data gathered during the first appraisal well and update the prevailing geological and other reservoir models...

Selling Israeli gas to Turkey? So at what price? Israel cannot compete in gas market,isn't competitive enough to compete with LNG [liquefied natural gas] from other countries.Israeli gas is not competitive under the current market conditions because of the declining gas prices and also highly expensive extraction costs of gas in the offshore deep water activities.What about the cost calculations based on the cost-effective metedology of pipes,transportation, regassification expenses and the total cost price? Israel wants to ensure it maximizes export revenues and can properly manage the facility’s security, making a terminal outside of Israeli territory unlikely. An alternative is an LNG facility within Israel, but environmental opposition, interference with tourist destinations, and competition for space with container ports present challenges to this approach.

The development of the Leviathan, which is again inching forward now that the Israeli government is settling its differences with Noble Energy and Delek Group, could be a significant milestone for the region. It will introduce a very large source of natural gas for Israel and its neighbors, providing an economic boost while offering potentially positive (although largely theoretical) geopolitical benefits. But talk of a larger “game changer” with the Leviathan is quite clearly overstated. Energy trade can contribute to positive cooperation, but it is unlikely to single-handedly transform the longstanding points of conflict between Israel and its neighbors.

Furthermore, exports to Europe are questionable, if not unlikely. A pipeline is too expensive, and LNG export terminals face technical challenges, not to mention long lead times. As a result, offshore gas in the Eastern Mediterranean will likely remain a regional story, rather than a global one. The Eastern Mediterranean is not an easy environment. Low prices will affect deep-water activities and could drive certain companies to reconsider certain projects that could become unprofitable...Under current market conditions, the prospects for upstream activity in the East Mediterranean is not particularly favorable, although other elements may be considered when it comes to the decision to be involved in a country’s oil and gas sector...Such developments could make the Eastern Mediterranean a difficult environment for medium-sized companies.This has forced companies to consider certain measures, such as cutting down their budget, abandoning costly projects, selling assets or even mergers...Natural gas project financing is different from oil. The main difference lies in marketability of gas. The problem with gas is transportation as pipelines are the best means but they have only two ends (seller and buyer) and are expensive to put in place. Furthermore, only regional markets exist for gas in which prices are different according to their regional demand...The nonexistence of international market is of a major concern to bankability of gas projects...

No long term contracts, no gas sales(exports)

Nice blog. Leviathan field Israel - Turkey pipeline project is important for both countries. Leviathan field is very important for Israel.

ReplyDelete